cryptocurrency tax calculator india

How To Use The India Cryptocurrency Tax Calculator. In This Video You Will Know Crypto Tax Value in Telugu.

Calculate Your Crypto Taxes With Ease Koinly

India became one of the few countries to impose tax on digital assets like cryptocurrencies and non-fungible tokens NFTs when finance minister Nirmala Sitharaman proposed a 30 per cent tax on.

. To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value. It is added to your taxable salary and you are taxed as per your income tax bracket. Bittax uses a tax planning algorithm mechanism and helps you organize and manage all your tax liabilities and profits keeping in mind the standard protocols of IRS.

Seeing a phenomenal increase in bitcoins or other cryptocurrency transactions. Cryptocurrency Tax Calculation 2022. BearTax is integrated with more than 25 crypto exchanges and just like any other tax software calculates all your assets gains losses imports data and files your tax document.

Any income arising on the transfer of bitcoins cryptocurrencies or other Virtual digital. The gains are short-term capital gains of Rs 120000 Rs 80000 Rs 40000. Traders Can Buy Sell Trade Cryptocurrencies All in a Single Hassel-Free Crypto Platform.

Ad New Approved Crypto Accounts Will Receive 10 in a Supported Cryptocurrency. From 1st April 2022 a lot of income tax rule changes announced in Budget 2022 will get implemented across nation. As per the IRS cryptocurrency or any virtual digital transactions are taxable by law just like transactions in any other property if you gained.

No deduction and exemption will be allowed. The Government of India has introduced a scheme for the taxation of virtual digital assets VDA through the union budget 2022. Income tax calculator.

Looking at growing popularity and lucrative gains government has announced 30 flat tax on income from the transfer of virtual digital assets VDAs including cryptocurrencies and NET. Tax Calculation Cryptocurrency Cryptocurrency is an emerging digital asset. Crypto tax indiacrypto taxation indiacrypto tax calculator indiacrypto tax in usacrypto tax calculatorcrypto tax in canadacrypto tax in dubaicrypto tax india.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency. Gu How to calculate the cryptocurrency tax described. Positive for crypto segment as digital asset acquisition to be taxed at 30.

Crypto Trader Investors currently need to pay 30 assessment on their Only benefits. To support our channel please register using the link below. BearTax - Cryptocurrency Tax Software for India.

Crypto mining bill. New income tax law on cryptocurrency and other digital. Cryptocurrency tax Information In India.

The holding period is less than 36 months. In addition to 30 of the tax you also need to pay cess at 4 of the tax amount. Crypto Tax Update in TeluguHow To Calculate Crypto Tax In TeluguCrypto Tax Explanation Titano Finance Links.

There will be a 30 tax on cryptocurrency in India. Long-term capital gain on crypto assets attract a capital gains tax of 20 per cent where the investor will get the benefit of indexation. You can not save tax if you will trade in cryptocurrency in India after 01042022.

According to the Budget 2022 announcement Tax Deducted at Source TDS will be imposed on payments for the transfer of crypto assets at a rate of 1 for transactions over a certain threshold. Following are the steps to use the above Cryptocurrency tax calculator for India. February 28 2022.

The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and long term capital gainsThe calculator is based on the principle of taxation enumerated by the IRS in the latest notice. It may sound like a negative news but lets dig in a little deeper and find out what are the facts about cryptocurrency tax in India. Tailored as per the Indian tax laws the algorithm provides an accurate report of your crypto gainslosses for a financial year.

Because there is no further deduction that will. Enter your total buying price of all the cryptocurrencies that you acquired. Cryptocurrency tax Information In India The government has proposed another duty system for the citizens in the Union Budget 2022.

Suppose you had purchased some Cryptocurrency units in June 2016 for Rs 80000 and sold them in October 2018 for Rs 300000. Crypto Investors should pay 30 expense on their benefits. However the Government has not clarified what this threshold will be.

Noting the phenomenal increase in transactions in virtual digital assets the FM said the magnitude and. In the Union Budget 2022-23 Finance Minister Nirmala Sitharaman on Tuesday announced tax rules for virtual assets which will impact crypto investors directly. Taxation on Cryptocurrency These examples calculate taxes for the FY 2022-23 for a person.

Many Indians are investing in Crypto. Heres how to calculate tax if investing in cryptocurrencies and NFTs in India. In the Union Budget 2022 crypto assets have been classified as virtual digital assets.

If the total taxable income of an investor excluding short-term gains is below the taxable income that is Rs 25 lakh one can adjust this shortfall against the short-term gains. Union budget 2022 proposed a scheme for the taxability of cryptocurrency. BearTax - Calculate Crypto Taxes in India.

Please refer to the example below. As per budget 2022 you will have to pay tax 30 on profit on the sale of any virtual digital assets cryptocurrency. For example if you bought Rs 50000 worth of Bitcoin BTC and Rs 60000 worth of Dogecoin DOGE enter 110000 in the Total Buying Price input field.

1 TDS on Crypto Assets. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Indias first crypto accounting and tax tool which has been vetted by a Chartered Accountant.

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

Capital Gains Tax Calculator Ey Global

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express

Cryptoreports Google Workspace Marketplace

Calculate Your Crypto Taxes With Ease Koinly

How Is Cryptocurrency Taxed Forbes Advisor

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

Crypto Tax Calculator Cryptotrader Tax

How To Report Cryptocurrency Gains Losses In Income Tax Return The Economic Times

Explained How Will Crypto Taxation Work In India

Calculate Your Crypto Taxes With Ease Koinly

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Tax Guides Help Koinly

India Gearing Up To Solidify Its Crypto Tax Laws

Cryptocurrency Tax Guides Help Koinly

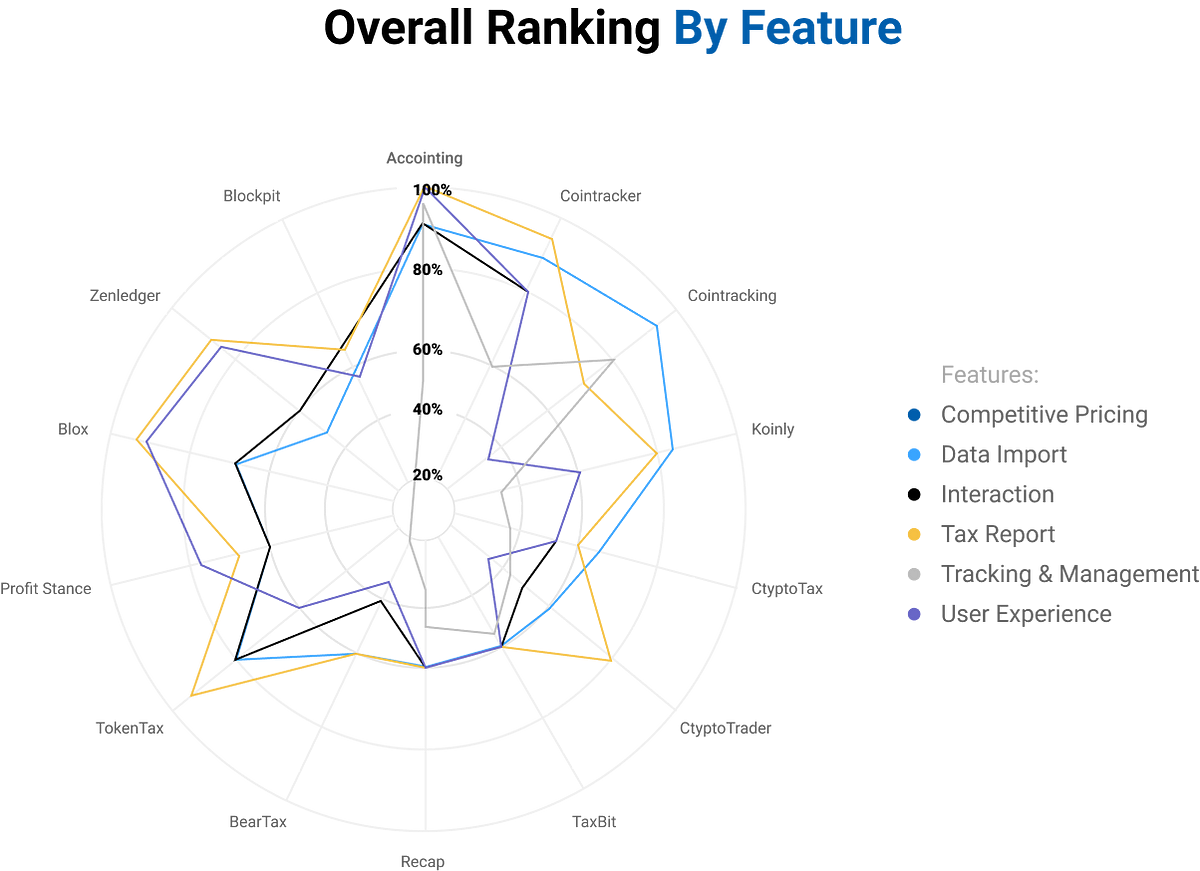

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks