proposed estate tax changes september 2021

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate PlanningPart 1. The effective date for this increase would be September 13 2021.

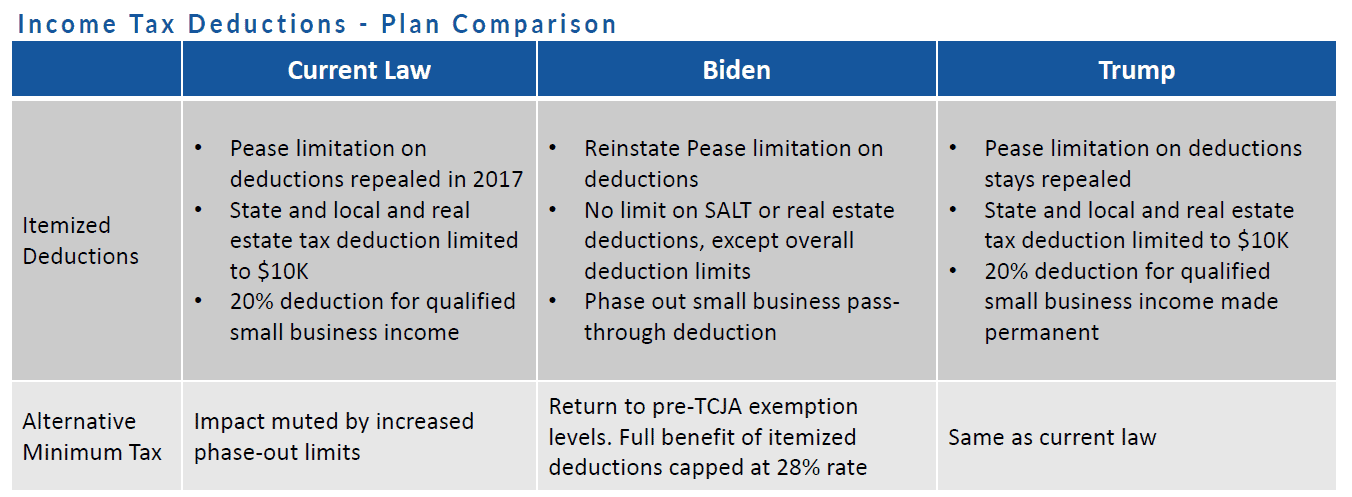

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

Increasing Capital Gains Rates.

. That is only four years away and. On September 13 2021 the House Ways and Means Committee released statutory language for its proposed tax. Final regulations establishing a user fee for estate tax closing letters.

Final regulations under 1014f and 6035. Proposed 25 Capital Gain Rate and Back to The Future. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to.

The For the 995 Percent Act. On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the. At this point many ideas are being evaluated but nothing is final.

The maximum rate at which capital gains are taxed would increase from 20 to 25 if the new bill were to pass. For now the federal estate. As a result of the proposed tax law.

Proposed Legislation Affecting Estate Taxes and Gift Plans. Proposed regulations were published on December 31 2020. This amount could increase some in 2022 due to adjustments for inflation.

This would impact the QSBS exclusion for sales taking place after September 13 2021 but an exception would exist for gain resulting from sales under binding contracts. These changes would be effective January 1 2022 except for the capital gains increase which would be effective as of the date of the proposal September 13 2021. If this proposal were to become.

The new bill would increase the long-term capital gains tax rate from 20 to 25 on individuals with taxable. November 16 2021 by admin. The 2021 exemption is 117M and half of that would be 585M.

Estates with assets in excess of the exemption would be subject to tax at graduated rates beginning at 45 percent for estates between US35 and US10 million and 50. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the.

Increase in Capital Gains Tax Rates. Corporate tax rates individual tax rates and capital gains taxes are also on the negotiating table. September 15 2021 Law Alert House Committee proposal includes widespread changes to current estate gift and income tax law Earlier this week the US.

The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million. On September 13 2021 Democrats in the. Concerned taxpayers and their advisors should pay attention to these potential developments as they may.

As of this writing on September 22 2021 no bill has been enacted. The proposed bill seeks to increase the 20 tax rate on capital gains to 25. Would reduce the estate tax exemption to 35 million from 117 million in 2021 and increase the progressivity of the estate tax with rates.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

Biden Tax Plan Details Analysis Biden Tax Resource Center

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Estate Tax In The United States Wikipedia

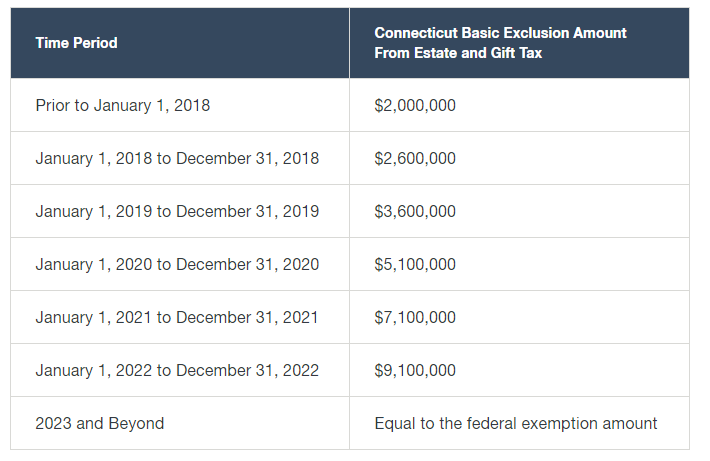

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

Hey President Biden What Are You Doing On Estate Taxes

Personal Planning Strategies Lexology

Biden Tax Plan Details Analysis Biden Tax Resource Center

Estate Planning Aeg Financial Page 2

Will 2021 See Changes To The Federal Estate Tax Brian Douglas Law

Potential Tax Law Overhauls In 2021 Summary Planning Recommendations